Revenue Cycle Management (RCM) is the backbone of financial operations for businesses that rely on invoicing, claims processing, and payment collections. The RCM Business App is a next-generation software solution designed to automate, streamline, and optimize the entire revenue cycle—from billing to payment reconciliation.

With rising operational costs and increasing regulatory demands, businesses need a smart, AI-driven platform to minimize revenue leakage, reduce administrative burdens, and maximize profitability. The RCM Business App leverages artificial intelligence, cloud computing, and real-time analytics to deliver a seamless financial management experience.

Why Businesses Need an RCM Solution

1. Challenges in Manual RCM Processes

- Human Errors: Manual data entry leads to billing mistakes.

- Delayed Payments: Slow claim processing affects cash flow.

- Regulatory Risks: Non-compliance with HIPAA, GDPR, or financial laws.

- Revenue Leakage: Unpaid invoices and denied claims reduce profits.

2. How RCM Business App Solves These Problems

✅ Automation – Eliminates repetitive tasks.

✅ Accuracy – AI detects errors before submission.

✅ Speed – Faster claims processing and reimbursements.

✅ Compliance – Built-in regulatory adherence.

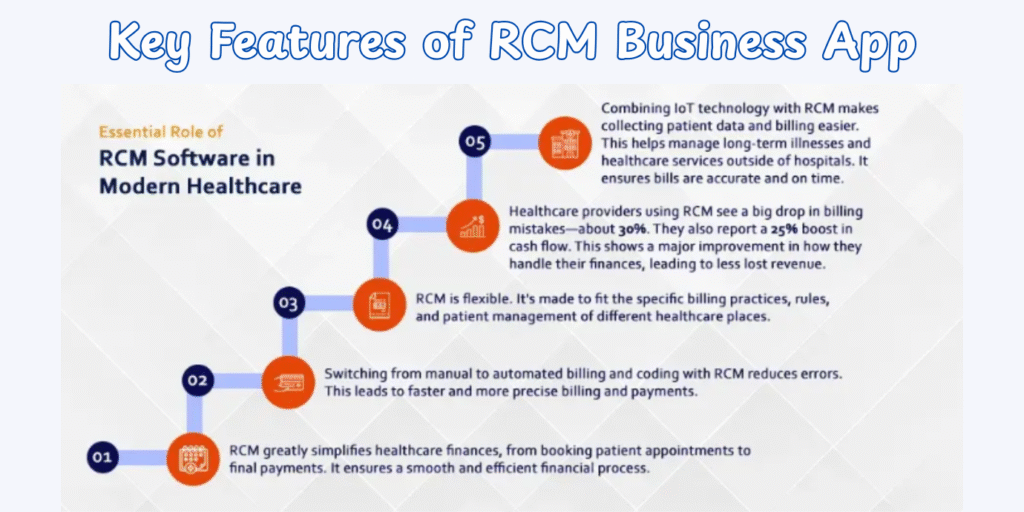

Key Features of RCM Business App

1. Intelligent Claims Management

- AI-powered claim scrubbing to reduce denials.

- Real-time tracking of insurance claims.

2. Automated Billing & Invoicing

- Customizable invoice templates.

- Recurring billing for subscriptions.

3. Payment Processing & Collections

- Multi-channel payments (credit cards, ACH, PayPal).

- Automated late-payment reminders.

4. Advanced Analytics & Reporting

- Predictive analytics for revenue forecasting.

- Custom dashboards for financial insights.

5. Patient/Client Self-Service Portal

- Online bill pay and payment history access.

- Reduces call center workload.

6. Seamless Integrations

- Works with EHR, QuickBooks, SAP, and more.

- API support for custom software needs.

How RCM Business App Enhances Financial Efficiency

1. Faster Reimbursements

- Reduces claim denial rates by 30-50%.

- Shortens payment cycles from weeks to days.

2. Improved Cash Flow Management

- Automated follow-ups on unpaid invoices.

- Real-time AR (Accounts Receivable) tracking.

3. Cost Savings

- Reduces staffing needs for billing departments.

- Cuts down on paper-based processes.

4. Better Customer Satisfaction

- Transparent billing with no hidden fees.

- Convenient online payment options.

Case Studies: Success Stories with RCM Business App

1. Case Study 1: Healthcare Clinic Boosts Revenue by 40%

- Challenge: High claim denial rates (25%).

- Solution: Implemented RCM Business App’s AI claim scrubbing.

- Result: Denials dropped to 5%, revenue increased by 40%.

2. Case Study 2: Insurance Firm Cuts Processing Time in Half

- Challenge: Manual claims took 14 days to process.

- Solution: Automated claims submission via RCM Business App.

- Result: Processing time reduced to 7 days.

Industries That Benefit from RCM Business App

| Industry | Use Case |

|---|---|

| Healthcare | Medical billing, insurance claims |

| Insurance | Faster claim adjudication |

| Finance | Loan repayment tracking |

| Legal | Time tracking & invoicing |

| E-Commerce | Subscription billing |

RCM Business App vs. Traditional Methods

| Feature | RCM Business App | Manual Methods |

|---|---|---|

| Speed | Instant claim submissions | Days/Weeks |

| Accuracy | AI-powered error checks | Prone to mistakes |

| Cost | Lower operational costs | High labor expenses |

| Scalability | Grows with business | Limited by staff |

How to Implement RCM Business App

1. Step 1: Assess Your Needs

- Identify pain points in your current RCM process.

2. Step 2: Choose a Plan

- Select a subscription (monthly/annual).

3. Step 3: Onboarding & Training

- Dedicated support for smooth setup.

4. Step 4: Go Live & Optimize

- Monitor performance and adjust settings.

Security & Compliance

- Bank-Level Encryption (AES-256).

- HIPAA & GDPR Compliant.

- Regular Security Audits.

Future of RCM Technology

- AI Chatbots for customer billing inquiries.

- Blockchain for fraud-proof transactions.

- Voice-Activated RCM Assistants.

The Evolution of Revenue Cycle Management

1. From Paper to Digital: A Historical Perspective

- The origins of RCM in healthcare and financial services

- How manual processes created bottlenecks and errors

- The digital transformation wave in financial operations

2. The Modern RCM Imperative

- Why traditional methods fail in today’s fast-paced environment

- The cost of inefficiency: real-world examples of revenue leakage

- Regulatory pressures driving automation adoption

3. Enter RCM Business App: A Paradigm Shift

- How next-gen solutions are redefining financial workflows

- The convergence of AI, cloud computing, and big data in RCM

- Competitive advantages gained through digital transformation

Understanding the RCM Business App Ecosystem

1. Architecture and Infrastructure

- Cloud-based vs. on-premise deployment options

- Microservices architecture for scalability

- API-first design for seamless integrations

2. User Experience and Interface Design

- Role-based dashboards for different stakeholders

- Mobile optimization for on-the-go management

- Accessibility features and multilingual support

3. The Partner Network

- Certified integration partners (EHR, ERP, PMS systems)

- Payment processor collaborations

- Implementation specialists and support teams

Deep Dive: Core Functionalities and Advanced Features

1. Intelligent Claims Processing Engine

- Natural Language Processing for claim form analysis

- Predictive denial prevention algorithms

- Automated appeals management for rejected claims

2. Dynamic Financial Analytics Suite

- Real-time cash flow visualization tools

- Predictive modeling for revenue forecasting

- Custom report builder with drag-and-drop functionality

3. Advanced Payment Automation

- Smart payment routing based on payer preferences

- AI-driven collection strategies for delinquent accounts

- Cryptocurrency and alternative payment acceptance

4. Compliance Guardian System

- Automated regulatory updates monitoring

- Audit trail generation for compliance reporting

- Role-based access control with biometric verification

Industry-Specific Applications and Customizations

1. Healthcare: Beyond Medical Billing

- Specialty-specific templates (Dental, Oncology, Behavioral Health)

- Prior authorization automation

- Patient responsibility estimation tools

2. Financial Services: The Next Frontier

- Loan servicing automation

- Fee schedule management

- Regulatory reporting for financial institutions

3. Retail and E-Commerce Innovations

- Subscription billing enhancements

- Chargeback prevention systems

- Multi-currency and tax compliance features

4. Government and Public Sector Adaptations

- Grant management modules

- Public health billing systems

- Municipal revenue collection tools

Implementation Roadmap: From Selection to Optimization

1. Phase 1: Needs Assessment and Vendor Selection

- Conducting a current-state workflow analysis

- Creating a weighted decision matrix for evaluation

- Security and compliance requirement checklists

2. Phase 2: Deployment Strategies

- Big bang vs. phased rollout approaches

- Data migration best practices

- Parallel testing methodologies

3. Phase 3: Training and Change Management

- Developing role-specific training programs

- Creating internal RCM champions

- Measuring user adoption metrics

4. Phase 4: Continuous Improvement

- Quarterly business reviews with success metrics

- User feedback incorporation cycles

- Roadmap planning for future enhancements

Download The This App

The Technology Behind RCM Business App

1. Artificial Intelligence Framework

- Machine learning models for payment pattern recognition

- Computer vision for document processing

- Chatbots for patient/provider inquiries

2. Blockchain Applications

- Smart contracts for automatic claim adjudication

- Immutable audit trails for compliance

- Decentralized identity verification

3. Cybersecurity Infrastructure

- Zero-trust architecture implementation

- Behavioral anomaly detection

- Disaster recovery protocols

Measuring Success: KPIs and ROI Analysis

1. Financial Metrics

- Days in Accounts Receivable (DAR)

- Clean claim rate percentages

- Cost to collect benchmarks

2. Operational Metrics

- Staff productivity measurements

- Automation rate tracking

- Exception handling times

3. Quality Metrics

- Customer satisfaction scores

- First-pass resolution rates

- Compliance audit results

4. Calculating ROI

- Hard cost savings quantification

- Soft benefit valuation methods

- Break-even analysis frameworks

Overcoming Common RCM Challenges

1. Challenge 1: Resistance to Change

- Strategies for stakeholder buy-in

- Success story communication plans

- Incentivization programs

2. Challenge 2: Data Quality Issues

- Master data management approaches

- Data cleansing techniques

- Ongoing data governance models

3. Challenge 3: Payer Policy Complexity

- Payer rules engine configurations

- Automated policy update systems

- Payer-specific workflow adaptations

4. Challenge 4: Scaling Operations

- Cloud elasticity features

- Automated workload distribution

- Global compliance management

The Future Landscape of RCM Technology

1. Emerging Technologies on the Horizon

- Quantum computing for risk modeling

- AR/VR for revenue cycle training

- IoT integration for real-time service verification

2. Industry Convergence Trends

- Healthcare-financial services hybrids

- Cross-border payment innovations

- Unified revenue operations platforms

3. The Human-Machine Collaboration

- Upskilling for the RCM workforce of tomorrow

- Ethical AI implementation guidelines

- The changing role of financial professionals

Taking the Next Steps: Your RCM Transformation Journey

1. Getting Started Options

- Interactive Demo: Hands-on exploration of the platform

- Pilot Program: Low-risk test with one department

- Full Implementation: Comprehensive enterprise rollout

2. Special Offers

- Free current-state RCM assessment ($5,000 value)

- Implementation cost credits for signing before [date]

- Extended training package with premium onboarding

3. Decision Support Resources

- ROI calculator tool with your specific data

- Reference calls with similar organizations

- Side-by-side comparison with competing solutions

See Also Ladai Wala Game

Ready to transform your revenue cycle? Contact our specialists today to schedule your personalized consultation and discover how RCM Business App can drive measurable financial improvement for your organization.

Solving Complex RCM Challenges with Intelligent Solutions

1. Challenge: Payer Policy Complexity

- Solution: AI-powered payer rules engine that auto-updates

- Result: 65% reduction in policy-related denials

2. Challenge: Staff Turnover Impact

- Solution: Digital twin technology for training

- Result: 50% faster onboarding of new team members

3. Challenge: Scaling for Growth

- Solution: Elastic cloud infrastructure

- Result: Seamless 300% volume increase handling

FAQ’s About RCM Business App

Is the RCM Business App cloud-based?

✅ Yes! Accessible from anywhere, anytime.

How does your system handle HIPAA compliance?

Our solution is HITRUST certified with automated compliance monitoring that alerts you to any potential issues in real-time.

What about integration with our legacy systems?

We’ve successfully integrated with 200+ different systems using our adaptive API framework, including many legacy platforms.

What’s the typical ROI timeframe?

Most clients see full ROI within 6-12 months, with some realizing benefits in as little as 90 days.

Can it integrate with my existing software?

✅ Absolutely! Works with EHR, ERP, and accounting tools.

How secure is my data?

✅ Military-grade encryption ensures safety.

Are there hidden costs we should know about?

A: We offer all-inclusive pricing with no surprise fees. Implementation, training, and standard integrations are all included.

Conclusion

The RCM Business App is not just a tool—it’s a strategic advantage for businesses looking to maximize revenue, reduce costs, and improve efficiency.