DMI Finance is a leading digital lending platform in India that provides quick and hassle-free personal loans, business loans, and consumer durable loans through its mobile app. The DMI Finance App is designed to offer a seamless borrowing experience with minimal documentation, instant approvals, and fast disbursals.

With a user-friendly interface, competitive interest rates, and flexible repayment options, the DMI Finance App has become a preferred choice for individuals and small businesses looking for financial assistance.

Why Choose DMI Finance App?

✅ Instant Loan Approval – Get approved within minutes.

✅ Paperless Process – No physical documentation required.

✅ Flexible Repayment – Choose EMI options as per your convenience.

✅ Secure & Safe – Advanced encryption for data protection.

✅ 24/7 Customer Support – Assistance whenever you need it.

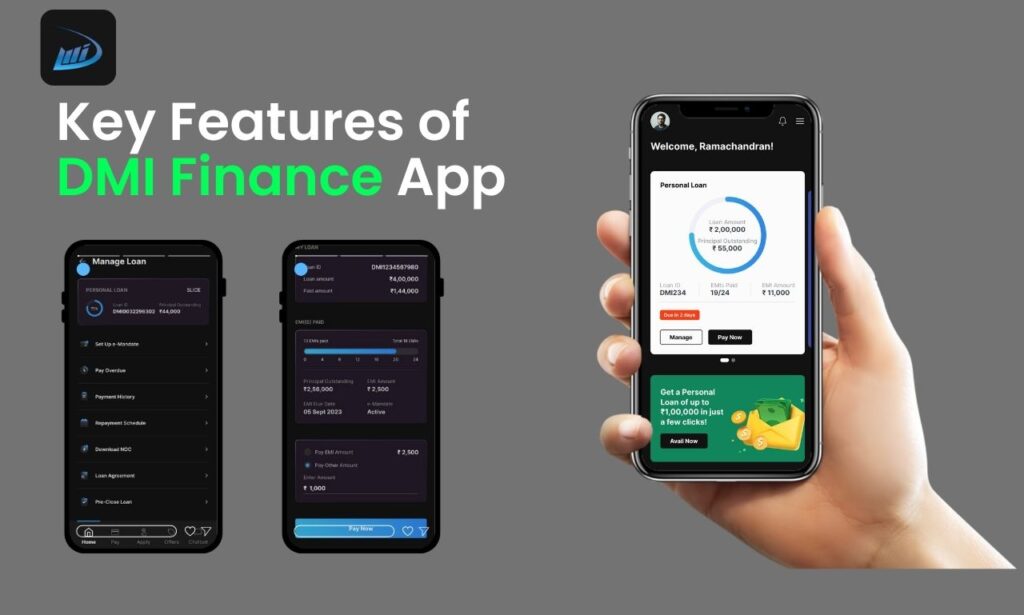

Key Features of DMI Finance App

The DMI Finance App comes packed with several features that make borrowing easy and efficient:

A. Quick Loan Disbursal

- Loans are disbursed within 24-48 hours after approval.

- Funds are directly transferred to your bank account.

B. No Collateral Required

- Unsecured loans without any need for guarantors or security.

C. Minimal Documentation

- Paperless KYC using Aadhaar, PAN, and bank statements.

D. Customized Loan Offers

- Personalized loan amounts based on credit score and eligibility.

E. EMI Calculator

- Plan repayments using the built-in EMI calculator.

F. Real-Time Application Tracking

- Track loan status in real-time via the app.

G. Secure Digital Process

- Bank-grade security to protect user data.

How to Download and Install the DMI Finance App

For Android Users:

- Open the Google Play Store.

- Search for “DMI Finance“.

- Click “Install” and wait for the download to complete.

- Open the app and proceed with registration.

For iOS Users:

- Open the Apple App Store.

- Search for “DMI Finance“.

- Tap “Get” and install the app.

- Launch the app and sign up.

How to Register and Create an Account

- Open the DMI Finance App and click on “Register”.

- Enter your mobile number and verify via OTP.

- Fill in personal details (Name, Email, PAN, Aadhaar).

- Complete e-KYC verification using Aadhaar-linked mobile.

- Set a secure password for your account.

- Your account is now ready for loan applications.

Types of Loans Offered by DMI Finance

A. Personal Loans

- Loan Amount: ₹10,000 to ₹10 Lakhs

- Tenure: 3 to 36 months

- Purpose: Medical emergencies, travel, education, etc.

B. Business Loans

- Loan Amount: ₹50,000 to ₹30 Lakhs

- Tenure: 6 to 48 months

- Purpose: Working capital, expansion, equipment purchase.

C. Consumer Durable Loans

- Loan Amount: Up to ₹5 Lakhs

- Tenure: 3 to 24 months

- Purpose: Purchase of electronics, furniture, etc.

Eligibility Criteria for DMI Finance Loans

| Parameter | Personal Loan | Business Loan |

|---|---|---|

| Minimum Age | 21 years | 25 years |

| Maximum Age | 60 years | 65 years |

| Minimum Income | ₹15,000/month | ₹1 Lakh/month |

| Credit Score | 650+ | 700+ |

| Employment | Salaried/Self-employed | Self-employed/Business owners |

Documents Required for Loan Application

- Identity Proof: Aadhaar, PAN, Voter ID

- Address Proof: Utility bill, Passport

- Income Proof: Salary slips, Bank statements (last 6 months)

- Business Proof (for business loans): GST, ITR, Business license

How to Apply for a Loan on DMI Finance App

- Log in to the DMI Finance App.

- Select the loan type (Personal/Business).

- Enter the required loan amount and tenure.

- Upload necessary documents.

- Submit the application and wait for approval.

Loan Approval and Disbursement Process

- Step 1: Application submitted.

- Step 2: Verification via phone call (if required).

- Step 3: Approval notification via SMS/email.

- Step 4: Loan agreement e-signing.

- Step 5: Disbursal within 24-48 hours.

Interest Rates and Fees

| Loan Type | Interest Rate (p.a.) | Processing Fee |

|---|---|---|

| Personal Loan | 12% – 24% | 1% – 3% of loan amount |

| Business Loan | 14% – 30% | 1.5% – 4% of loan amount |

Repayment Options and EMI Calculation

- EMI Options: Flexible tenure (3-48 months).

- Auto-Debit Facility: Automatic EMI deduction from bank account.

- Prepayment Option: Available with minimal charges.

Example EMI Calculation:

- Loan Amount: ₹1 Lakh

- Tenure: 12 months

- Interest Rate: 18% p.a.

- EMI: ₹9,168 (approx.)

Benefits of Using DMI Finance App

✔ Quick Approval – Instant loan processing.

✔ No Hidden Charges – Transparent fee structure.

✔ Flexible Tenure – Choose repayment as per convenience.

✔ Credit Score Improvement – Timely repayments boost CIBIL score.

Security and Privacy Features

- 256-bit SSL Encryption for data protection.

- Biometric Authentication for secure login.

- No Data Sharing with third parties.

Customer Support and Grievance Redressal

- Email: [email protected]

- Phone: 1800-123-4567

- Live Chat: Available on the app.

DMI Finance App vs Competitors

| Feature | DMI Finance | MoneyTap | KreditBee |

|---|---|---|---|

| Loan Amount | Up to ₹10 Lakhs | Up to ₹5 Lakhs | Up to ₹2 Lakhs |

| Interest Rate | 12%-24% | 13%-24% | 16%-30% |

| Processing Time | 24-48 hours | 2-3 days | 1-2 days |

User Reviews and Ratings

⭐ 4.3/5 (Google Play Store)

👍 “Fast approval and good customer service!” – Rahul K.

👎 “High interest rates for low CIBIL score.” – Priya M.

Tips for Getting Instant Loan Approval

- Maintain a CIBIL score above 700.

- Provide correct income details.

- Ensure all documents are clear and valid.

Common Issues and Troubleshooting

❌ OTP Not Received?

- Check network connection.

- Request OTP again.

❌ Loan Rejected?

- Improve credit score.

- Reapply after 3 months.

Future Updates and Enhancements

- Credit Line Facility (Coming Soon).

- Lower Interest Rates for loyal customers.

FAQs About DMI Finance App

Is DMI Finance App safe?

✅ Yes, it uses bank-level security.

What is the maximum loan amount?

✅ Up to ₹10 Lakhs for personal loans.

Can I prepay the loan?

✅ Yes, with minimal charges.

Conclusion

The DMI Finance App is a reliable and efficient digital lending platform that provides quick loans with minimal documentation. Whether you need a personal loan, business loan, or consumer durable financing, DMI Finance offers competitive interest rates and flexible repayment options.

Download the app today and experience hassle-free borrowing!